Table of Content

AI agents, also known as intelligent agents or AI Assistants, are software programs that are designed to perform tasks with human-like intelligence. These agents can perceive their environment, make decisions, and take actions to achieve a specific goal. They use a combination of technologies such as large language models (LLMs) and deep learning algorithms that allow them to learn from data and adapt to any new or unseen situations.

- Autonomy: AI agents are self-governing and can operate in real-time without human intervention.

- Reactivity: These intelligent agents can sense and respond to changes in the environment or user requests.

- Proactivity: AI agents can initiate actions to achieve a specific goal or solve a problem. This attribute is particularly crucial in O2C processes, where agents can proactively identify potential issues (e.g., delayed payments, invoice discrepancies) and take corrective actions.

- Social Ability: AI agents can interact and communicate with other systems or humans when needed in a natural language.

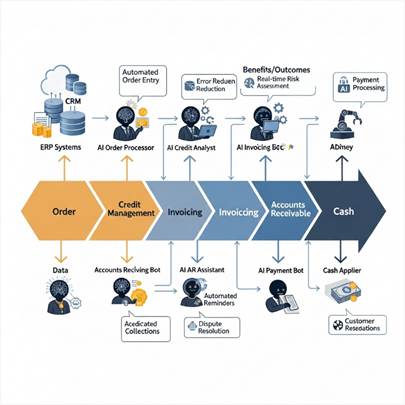

How AI Agents Work in the Order-To-Cash (OTC) Process

AI agents utilize a combination of different technologies, such as large language models (LLMs) and smart algorithms, to automate and optimize the order-to-cash (OTC) process. OK. It’s good. But…how does it actually work? Well, here’s how AI agents can help automate the order-to-cash process.1

1. Order Management

AI agents can handle customer orders through various channels such as email, phone, or online chat. These agents use natural language processing (NLP) techniques to understand and validate order information, like product details, quantities, and delivery addresses.

2. Order Fulfillment

AI agents not only automate data entry but also assist in the order fulfillment process. AI agents can use predictive analytics to forecast and optimize inventory levels, ensuring that products are always available when needed. For instance, if a particular product is selling faster than expected, the AI agent can automatically reorder it to avoid stockouts.

3. Order Route Optimization and Tracking

What would you do if you had to deliver hundreds of orders across different locations in a single day? What if a customer requests changes to their delivery location or time? Well, AI agents can handle all of that, too. These agents use algorithms and real-time data to optimize delivery routes and schedules, taking into account factors such as delivery priority and traffic conditions.

4. Automated Invoicing

Invoice generation and management are crucial parts of the OTC process, and AI agents can handle this task efficiently. AI agents can extract relevant information from purchase orders, customer agreements, and sales quotes to automatically generate invoices.

5. Payment Processing

Aside from tracking and managing invoices, AI agents can streamline the payment processing stage of the OTC process. These agents can automatically match payments to the interrelated invoices, which significantly reduces the chances of errors and speeds up the process.

6. Reporting and Analytics

AI agents give businesses a 360-degree view of the entire order-to-cash process. By collecting and analyzing data from various sources, including customer interactions, sales orders, and invoices, AI can generate real-time dashboards and reports.

7. Customer Interactions

Apart from reporting and predictive analytics, AI agents can also interact with customers in real-time to provide personalized and proactive support. Through natural language processing, AI agents can understand customer inquiries, complaints, or feedback and respond appropriately.

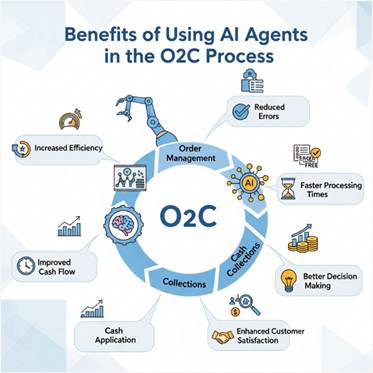

What are the Benefits of Using AI Agents in the O2C Process?

These autonomous agents can do much more than just automate manual tasks; they are intelligent, self-learning, and adaptable. AI agents can be customized to your specific business needs and integrated with your existing ERP/CRM systems, like SAP, MS Dynamics 365, or Oracle, and popular email clients (like Outlook or Gmail) without changing your current workflows. From tracking order status to responding to customer queries, AI agents can transform your O2C process in many ways, such as:

1. Improve Efficiency and Accuracy

By automating non-creative, repetitive tasks, such as data entry, validation, invoice generation, document analysis, and customer interactions, AI agents can significantly reduce the time and effort required to complete these tasks manually. This results:

- Your team can focus on more value-added tasks, like building customer relationships and driving business growth.

- Improved data accuracy and consistency for better decision-making.

- Reduced risk of human error, rework, or delays.

- Increased productivity and faster turnaround times.

2. Data-Driven Decision Making

AI agents collect, process, and analyze data in real-time. This gives you access to accurate, up-to-date data insights that you can use to make informed decisions and drive business growth. Through predictive analytics, AI agents can forecast demand, identify patterns, and recommend strategies for better financial performance.

3. Enhanced Customer Experience

With AI-powered chatbots, your customers can get quick and accurate responses to their queries without having to wait for a human agent. AI agents use natural language processing (NLP) to understand the intent behind the customer’s query and provide a human-like response, ensuring a seamless customer experience.

4. Reduce Costs and Better Scalability

AI agents require minimal human intervention; once implemented, they can work around the clock without any coffee breaks, sick leaves, or vacations. They can handle a vast amount of data and tasks simultaneously at a fraction of the time and cost compared to manual efforts.

5. Continuous Learning and Improvements

Unlike rule-based automation tools such as OCR and RPA, which require manual adjustments and retraining for every new document or task, AI agents use LLMs to automatically learn and improve over time from new data inputs and customer feedback.

In Which Ways Does AI Support Order to Cash Automation?

Artificial Intelligence (AI) plays a crucial role in supporting Order to Cash (O2C) automation by enhancing efficiency, accuracy, and decision-making throughout the O2C process. Here are some ways in which AI supports O2C automation.

Automated Data Entry

AI-powered Optical Character Recognition (OCR) technology can extract data from various documents, such as purchase orders and invoices. This eliminates the need for manual data entry, reducing errors and speeding up the order processing.

Dynamic Pricing

AI can adjust pricing in real-time based on factors like demand, competitor pricing, and inventory levels. This dynamic pricing strategy can maximize revenue while remaining competitive.

Credit Risk Assessment

AI can assess the creditworthiness of customers by analyzing their financial history and behaviour. It helps in making informed decisions about extending credit or setting credit limits.

Customer Insights

AI analyzes customer data to provide insights into buying behavior and preferences. This information can be used to personalize offers and improve customer engagement.

Order Routing and Fulfillment

AI algorithms can determine the most efficient route for order delivery, taking into account factors like location, traffic, and delivery times. This optimizes the supply chain and ensures timely deliveries.

Invoice Matching

AI can automatically match invoices with purchase orders and receipts. It identifies discrepancies and ensures that invoices are accurate, reducing the risk of disputes.

Payment Predictions

AI can predict when customers are likely to make payments. This helps in managing cash flow and prioritizing follow-ups with overdue accounts.

Fraud Detection

AI can identify suspicious transactions and patterns that may indicate fraud. This helps in preventing fraudulent orders and chargebacks.

Document Management

AI-driven document management systems can organize and retrieve documents quickly. This is especially useful for retrieving supporting documents like contracts and delivery receipts.

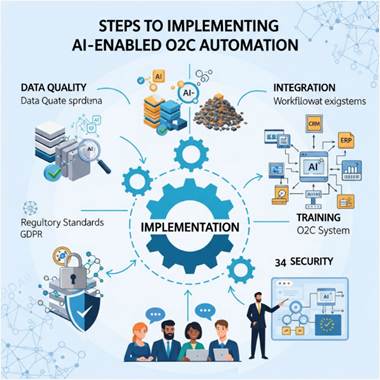

Steps to Implementing AI-Enabled O2C Automation:

Implementing AI-enabled O2C automation requires careful planning and consideration. Key considerations include:

- Data quality: AI relies on accurate, high-quality data to function optimally, so businesses need to ensure their data is clean and structured.

- Integration: The solution needs to be integrated into existing systems and workflows to achieve maximum efficiency.

- Training: Staff need to receive adequate training to understand how the system works and how to use it.

- Security: Implementation must consider data security and compliance requirements.

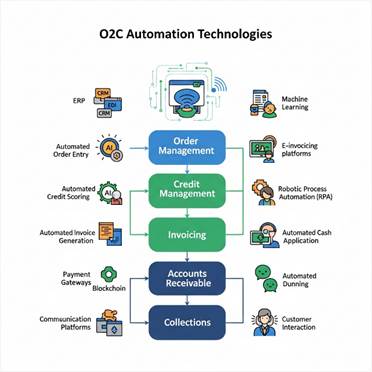

What Technology is Used in O2C Automation?

Order to Cash (O2C) automation leverages several key technologies to streamline and optimize the order processing cycle. These technologies work together to improve efficiency, accuracy, and overall performance. Here are the primary technologies used in O2C automation:

Machine Learning (ML)

ML algorithms can learn from historical data and adapt to changing circumstances. In O2C automation, ML is used for tasks like fraud detection, risk assessment, and predictive analytics to optimize the order process.

Robotic Process Automation (RPA)

RPA bots can perform rule-based, repetitive tasks with precision and speed. In O2C, RPA can handle data extraction, order entry, and other routine tasks, reducing human error and processing times.

Data Analytics

Advanced data analytics tools are used to analyze large datasets, providing insights into customer behavior, sales trends, and order processing bottlenecks. These insights inform decision-making and process improvements.

Cloud Computing

Cloud-based O2C automation solutions offer scalability, accessibility, and real-time data sharing among team members, regardless of their physical location. Cloud platforms also provide robust security and disaster recovery capabilities.

Big Data

O2C automation deals with vast amounts of data, from customer orders to inventory levels. Big data technologies help manage and process this data efficiently, enabling better decision-making and demand forecasting.

Document Management

Document management systems and Optical Character Recognition (OCR) technology help convert physical documents into digital formats, making them easier to manage and retrieve.

AI-Enabled O2C Automation Examples

Several companies are already leveraging AI-Enabled O2C automation with great success, including:

- A leading telecommunications company automated the collection of bank statements, freeing up staff to focus on high-value tasks and reducing manual input errors by up to 80%.

- A finance department in a global insurance organization automated about 40% of routine accounting processes, reducing data entry time by 90% and achieving 100% payment matching accuracy.

- A retails company automated their invoicing system, which reduced the time taken to generate invoices by 80%, leading to improved cash flow.

Conclusion

AI agents are transforming the Order-to-Cash (O2C) process by moving beyond basic automation to intelligent, end-to-end orchestration. By combining autonomy, real-time decision-making, and continuous learning, AI agents help businesses accelerate order cycles, reduce errors, improve cash flow, and deliver a better customer experience. As organizations scale and complexity increases, AI-enabled O2C is no longer a future concept—it is a strategic advantage.

Read more : microsoft copilot in dynamics 365 customer service

FAQ’s

AI agents can learn, adapt, and make decisions, while traditional tools like RPA follow fixed rules and require frequent manual updates.

Yes, AI agents can seamlessly integrate with platforms like SAP, Microsoft Dynamics 365, and Oracle without disrupting current workflows.

When implemented correctly, AI agents follow strict security, compliance, and access-control standards to protect sensitive data.

No, AI agents operate autonomously in real time, only involving humans when exceptions or approvals are required.

is a software solution company that was established in 2016. Our quality services begin with experience and end with dedication. Our directors have more than 15 years of IT experience to handle various projects successfully. Our dedicated teams are available to help our clients streamline their business processes, enhance their customer support, automate their day-to-day tasks, and provide software solutions tailored to their specific needs. We are experts in Dynamics 365 and Power Platform services, whether you need Dynamics 365 implementation, customization, integration, data migration, training, or ongoing support.

is a software solution company that was established in 2016. Our quality services begin with experience and end with dedication. Our directors have more than 15 years of IT experience to handle various projects successfully. Our dedicated teams are available to help our clients streamline their business processes, enhance their customer support, automate their day-to-day tasks, and provide software solutions tailored to their specific needs. We are experts in Dynamics 365 and Power Platform services, whether you need Dynamics 365 implementation, customization, integration, data migration, training, or ongoing support.